By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

Hey everyone!

My Bitcoin hedge short is still active, and I’ll provide an update today. In the meantime, I’m exploring some promising entry points for today’s altcoins, particularly one of my top picks this cycle: Sui (SUI).

Let’s take a look!

🚨 Crypto Banter x Blofin Exclusive Offer! 🚀

Join Blofin now and score BIG rewards just for Crypto Banter viewers and readers!

💰 Deposit and trade to earn up to 20% of your deposit amount PLUS extra rewards based on your trading volume.

⏰ Hurry! This deal ends May 28, 2025, and is limited to the first 3,000 users. Don’t miss out—act fast!

Example: Deposit 100 USDT, receive $20 Futures Bonus. Click below to see more deals. Terms and conditions apply. 👇

Overview

Chart #1 - Solana (SOLUSDT) 8-Hour

Chart #2 - Bitcoin (BTCUSD) 1-Day

Chart #3 - Sui (SUIUSD) 1-Day

Chart #4 - Cardano (ADAUSD) 8-Hour

Chart #5 - Chainlink (LINKUSD) 1-Day

Chart #6- Estée Lauder (EL) 1-Month (Long-Term Trade)

Chart #1 - Solana (SOLUSDT) 8-Hour

Chartist: Kyle

(For the chart screenshot, click here.)

Following a weak rejection into resistance, SOL has failed to reclaim the Yearly Open and is now rolling over as BTC trades at all-time highs. The chart is showing signs of weakness — we’re watching for a breakdown below the 200 and 21 EMAs to confirm momentum shift. Entry is on a retest of underside resistance, aiming to trade it back down into our original buy zone.

Entry: $165–$160

Stop Loss: $180

Take Profit Targets:

TP1: $153

TP2: $143

TP3: $131

TP4: $120

Trade it on Blofin and earn rewards here.

Get more exclusive trades from Kyle and his team by joining The Whale Room with a 2-week free trial! 👇

Limited Offer: Get 2 Weeks Free Access To The Whale Room Today!

You’re Not a Bad Trader. You’re Just Trading Alone.

Every week, traders in The Whale Room are front-running the market—not with hopium, but with structure, system, and strategy. While most traders chase pumps or hesitate at key levels, we’re already positioned—trading both directions with proven systems and an edge.

What You Get When You Join:

High-conviction trade ideas across BTC, alts, and legacy markets

Daily breakdowns + live Q&A with full-time pro traders

Tailored educational content designed to level you up

A focused, no-noise community to sharpen your edge

Join The Whale Room — 2 Weeks Free. No Commitment.👇

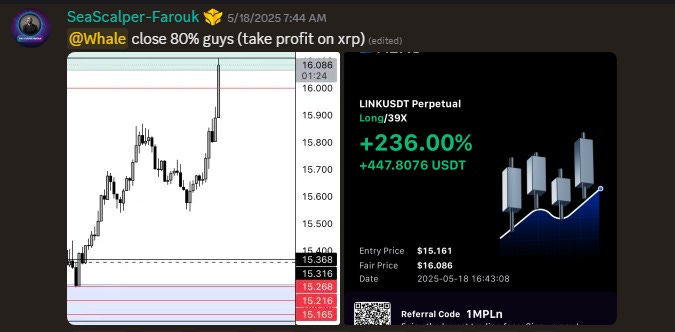

Meet Farouk—our expert scalper, showing members how to find consistent setups and extract profits, even in the toughest market conditions.

Whether you're just starting out or looking to refine your edge, you’ll gain real insights alongside experienced traders.

Chart #2 - Bitcoin (BTCUSD) 1-Day

Chartist: Kyle

(For the chart screenshot, click here.)

TRADE UPDATE: Bitcoin Hedge Short (BTC)

Following up on the short setup shared a couple weeks back — BTC is now trading in the optimal short zone. Historically, rejections from all-time highs have triggered drawdowns between 15% and 40%. We’ll watch closely today for a sweep of the highs followed by a rollover that fails to close above $106,000— that would be the trigger for a deeper retrace to sweep downside liquidity.

Stop Loss: $110,000, or 5-day close above $106,000

Take Profit Targets:

TP1: $94,000

TP2: $88,500

TP3: $84,500

Trade it on Blofin and earn rewards here.

Get 2 weeks of free access to The Whale Room for more trades and alpha from Kyle!👇

Chart #3 - Sui (SUIUSD) 1-Day

Chartist: Kyle

(For the chart screenshot, click here.)

In the event of a quick liquidation sweep clearing downside liquidity, BTC may gain strength for a stronger push up — and SUI remains one of my top picks this cycle. It’s consistently outperformed most assets and continues to show relative strength. A retrace into the FVG presents an ideal opportunity to position early.

Entry: $2.70 zone (I’ll ladder orders above and below)

Stop Loss: Daily close under $2

Take Profit Targets:

TP1: $3.80

TP2: $4.50

TP3: $5.50

TP4: $6.80

Trade it on Blofin and earn rewards here.

Get 2 weeks of free access to The Whale Room for more trades and alpha from Kyle!👇

Good Morning Crypto

Is Bitcoin on the verge of a historic all-time high, and which altcoins could skyrocket with the GENIUS Stablecoin Act?

Find out in today’s issue of Good Morning Crypto! 👇

Chart #4 - Cardano (ADAUSD) 8-Hour

Chartist: Kyle

(For the chart screenshot, click here.)

TRADE UPDATE: Cardano (ADA)

After the swing failure pattern at the Yearly Open, ADA is retracing back into our original buy zone. We’re now watching closely for signs that the higher low will hold. Look for either a deviation and reclaim of the support box, or a clear CHoCH to signal a momentum shift. If BTC continues to hold up, ADA is well-positioned for a move from this level.

Entry Zone: $0.72

Stop Loss: Daily close below $0.66

Take Profit Targets:

TP1: $0.85

TP2: $0.96

TP3: $1.07

Trade it on Blofin and earn rewards here.

Get 2 weeks of free access to The Whale Room for more trades and alpha from Kyle!👇

Chart #5 - Chainlink (LINKUSD) 1-Day

Chartist: Kyle

(For the chart screenshot, click here.)

If BTC breaks out to new all-time highs this week, LINK is well positioned to follow with strength. Price is currently testing the 200-day EMA — I’ll wait for confirmation of support and renewed momentum in BTC for a high-probability entry.

Entry: $16

Stop Loss: Daily close below $14.50

Take Profit Targets:

TP1: $19.80

TP2: $24

TP3: $27

Trade it on Blofin and earn rewards here.

Get 2 weeks of free access to The Whale Room for more trades and alpha from Kyle!👇

Chart #6- Estée Lauder (EL) 1-Month (Long-Term Trade)

Chartist: Kyle

(For the chart screenshot, click here.)

(EL refers to the stock of Estée Lauder and not a cryptocurrency.)

Estée Lauder has garnered renewed attention following the release of Michael Burry’s (The Big Short) Q1 portfolio update, where he either exited or flipped short on nearly every position — except for a long position in Estée Lauder. While the company faced a tough quarter, there are encouraging signs in the latest earnings report. EL managed to gain market share in key regions like the U.S., China, and Japan, with flagship brands Clinique, The Ordinary, and La Mer continuing to perform well. The company also maintained strong cash flow, launched an aggressive Profit Recovery and Growth Plan, and showed relative strength in its fragrance division — a higher-margin segment.

Despite a cautious short-term outlook, the fundamentals and strategic moves suggest Estée Lauder may be setting the stage for a broader recovery in the luxury beauty space.

Long-Term Trade Setup:

Entry: $65

Stop Loss: Monthly close under $48

Take Profit Targets:

TP1: $100

TP2: $150

TP3: $220

Get 2 weeks of free access to The Whale Room for more trades and alpha from Kyle!👇