Overview

Chart #1 - Hyperliquid (HYPEUSDT) 2-Hour

Chart #2 - Sui (SUIUSDT) 4-Hour

Chart #3 - Shiba Inu (SHIBUSDT) 4-Hour

Chart #4 - Moo Deng (MOODENGUSDT) 8-Hour

Chart #5 - Bitcoin (BTC) 1-Day & Dominance

Chart #6 - Pendle (PENDLEUSDT) 12-Hour

Chart #7 - Injective (INJUSDT) 2-Hour

Chart #8 - NVIDIA Corporation (NVDA) 1-Day

Chart #1 - Hyperliquid (HYPEUSDT) 2-Hour

Chartist: Dylan’s Chart Hackers Team

(For the chart screenshot, click here.)

HYPE completed a clean 0.618/Hacker Zone retracement from yesterday’s pump. It appears to be forming a higher-timeframe head-and-shoulders pattern as it approaches bearish order blocks visible on ChartPrime. This aligns with a hidden bearish divergence and a blue reversal dot that appeared on the most recent two-hour candle, as well as a 12-hour hidden bearish divergence on ChartPrime.

Entry: $39.75-$43.00

Take Profit (TP):

TP1: $37.25

TP2: $33.75

TP3: $31.50

TP4: $26.75

Stop Loss: 4-Hour close above: $44.35

Limited Time Offer: Get 2 Weeks Free Access!

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇

Join now to:

Access exclusive automated trading bots and indicators.

Join a private trading community on Discord & Telegram.

Learn expert entry and exit strategies from top traders.

Get real-time insights and high-level trade ideas.

Suitable for both beginners and advanced traders.

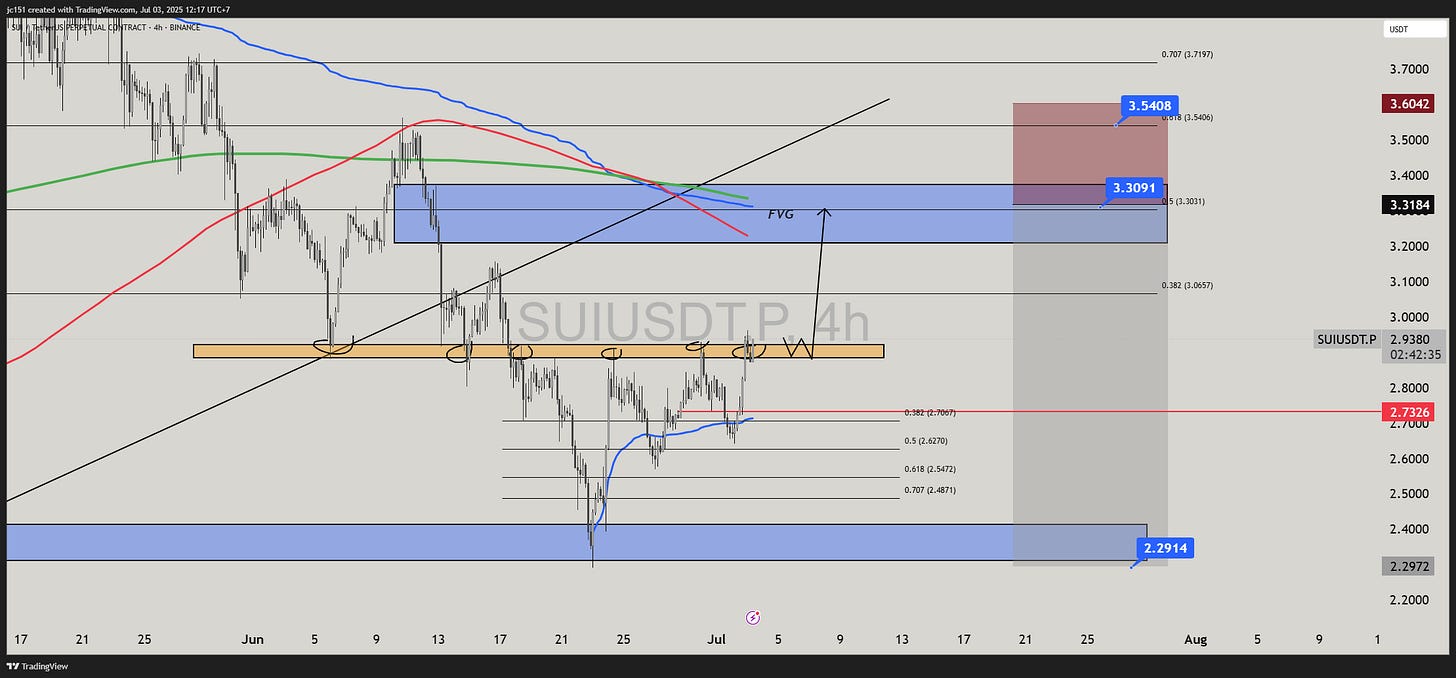

Chart #2 - Sui (SUIUSDT) 4-Hour

Chartist: Dylan’s Chart Hackers Team

(For the chart screenshot, click here.)

The price of SUI has broken out of a multi-tap resistance zone and is now heading into a high-confluence area that includes a bearish FVG, the 0.5 Fib retracement from the major swing, and the underside of the trendline. Adding further pressure are key moving averages: the 200-day SMA (green), the 50-day SMA (red), and the AVWAP from the local high (blue). This makes the $3.30–$3.54 zone an ideal area for a reversal. The setup aligns with potential market-maker sell-side activity (MMS) into Fib rebalancing.

Entry: $3.30–$3.54

Take Profit (TP):

TP1: $2.73

TP2: $2.29

Stop Loss: $3.60

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇

Chart #3 - Shiba Inu (SHIBUSDT) 4-Hour

Chartist: Dylan’s Chart Hackers Team

(For the chart screenshot, click here.)

Low leverage reaction based trade idea. This is a low leverage reaction based idea for SHIB. The entry triggers on a break above the June 16 resistance, clearing the equilibrium zone, with a stop loss on any rejection back into that zone. Profit targets are set at the anchored VWAP from the high, the money-flow point of control, and nearby order-block clusters. Confluence comes from an RSI false-top divergence, cash-flow flipping from negative to positive, and expanding green MACD histogram bars. If price instead rejects and returns to equilibrium, the alternative is to short down to the lower anchored VWAP and order block.

Entry: $0.00001234 region

Take Profit (TP):

TP1: $0.00001341 region (9% profit)

TP2: $0.00001431 region (15% profit)

Stop Loss: $0.000012 region (candle close below) - 3%

This setup offers approximately a 5:1 reward-to-risk ratio if TP2 is hit.

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇

Chart #4 - Moo Deng (moodengsol.com) (MOODENGUSDT) 8-Hour

Chartist: Dylan’s Chart Hackers Team

(For the chart screenshot, click here.)

MOODENG is showing strength, currently sitting on the 50 SMA and attempting to reclaim it. If successful, this could lead to further expansion in a bullish market, targeting the Previous Month High (PMH) or Yearly Open (Y.O.). Here, I have two short options:

Option 1

Entry: $0.229-$0.24

Take Profit (TP):

TP1: $0.193

TP2: $0.165

TP3 $0.147

Stop Loss: 4-Hour Close Above $0.24

Leverage: 3x-5x

Option 2

Entry: $0.262-$0.282

Take Profit (TP):

TP1: $0.233

TP2: $0.20

TP3: $0.17

Stop Loss: 4-Hour Close Above $0.2824

Leverage: 3x-5x

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇

Chart #5 - Bitcoin (BTC) 1-Day & Dominance

Chartist: Dylan

Bitcoin (BTCUSD) 1-Day

(For the chart screenshot, click here.)

BTC has broken out of the current channel and may be primed for a push to an all-time high (ATH). The daily oscillator still shows bullish strength. Key support levels on the daily chart for this push to ATH are $108,000 and $106,000.

BTC Dominance (BTC.D) 12-Hour

(For the chart screenshot, click here.)

BTC.D has been respecting basic TA, providing us guidance on when to be aggressive with longs and when to scale back. DOM currently sits at a major bounce zone that could favor BTC over alts with approximately a 65% probability. If BTC.D breaks lower, alts should get a second wind and push to new highs.

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇

Chart #6 - Pendle (PENDLEUSDT) 12-Hour

Chartist: Dylan

(For the chart screenshot, click here.)

PENDLE is still below the 200-day MA resistance, but may push higher, considering ETH has had a major break of its own 200-day MA. The premise is that PENDLE breaks through this resistance and rallies toward the next major rejection zone at $4. The bullish divergence on the 12-hour chart supports this view.

Entry, Low Leverage, Long: $3.65-$3.55

Take Profit (TP): $3.95

Stop Loss: Close below $3.5

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇

Chart #7 - Injective (INJUSDT) 2-Hour

Chartist: Dylan

(For the chart screenshot, click here.)

INJ has pumped hard over the last few days but is now moving into the first of two major rejection zones. The lower-timeframe oscillators are showing initial signs of exhaustion, making this a decent risk-reward hedge-short opportunity.

Entry 1: $12-$12.3

Take Profit (TP):

TP1: $11.3

TP2: $10.8

Stop Loss: Close above $12.4

Entry 2: $12.7-$13

Take Profit (TP):

TP1: $12

TP2: $11.6

TP3: $11.2

Stop Loss: Close above $13

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇

Chart #8 - NVIDIA Corporation (NVDA) 1-Day

Chartist: Dylan

(For the chart screenshot, click here.)

The bulls are back for NVDA after a wobble earlier this year due to tariffs and the Deep Seek news. The oscillator is showing reversal signs, and it’s a bit risky to jump in at these levels. I do, however, like NVDA longs in the $140–$145 and $130–$135 regions. I’ll update this regularly on my show as I wait for an entry.

Get more exclusive trades from Dylan and his team by joining Chart Hackers with a 2-week free trial today! 👇