📈📉 Longing these two coins right now could bring us massive gains!

Bitget winner - 9726592745

Chart #1 - Fantom (FTMUSDT) 12-Hour Chart

Chartist: Sheldon

(For the chart screenshot, click here.)

This morning FTM dropped with the rest of the crypto market, going from $0.45 to $0.39. FTM has since recovered and is currently trading at roughly $0.42.

If BTC goes up from here, FTM could retest its previous support, which is now resistance, at around $0.4350 - $0.45. The next significant resistance level after that is still $0.50, which FTM breached over a week ago, and has been unable to reclaim since.

If the market continues dropping, and FTM loses its $0.40 support, the next major support level is at $0.30.

Check our Crypto Banter Discord here for updates!

Follow me on Twitter for urgent updates on my trading progress!

Claim your Bitget sign-up bonuses here (details below).

Chart #2 - Arweave (ARUSDT) 1-Day Chart

Chartist: Kyle

(For the chart screenshot, click here.)

AR has tapped its range low at $8.27.

So long as that level holds, it presents us with a massive opportunity to go long. We would be targeting the mid-range level at $13 initially. Once we get there we can consider targeting the range-high next, at $18.

Check our Crypto Banter Discord here for updates!

Make sure to follow me on Twitter, where I will post updates on my trades as they unfold!

Claim your Bitget sign-up bonuses here (details below).

Last week we looked at Options Trading Data Tables, also known as Options Chains, in which we mentioned Implied Volatility. This week we will look at Implied Volatility more in-depth. Please note that this is for educational purposes only.

In options trading, implied volatility is a measure of how much the market expects the price of an underlying asset to fluctuate in the future. It's called "implied" because it's not directly observable, but rather is inferred from the price of the option.

Here's an analogy to help explain it: imagine you're playing a game of poker, and you're trying to guess the strength of your opponent's hand. One way to do this is to look at the amount they bet. If they bet a large amount, you might infer that they have a strong hand, because they're willing to risk a lot of money on it. In the same way, the price of an option can give you information about how much the market expects the underlying asset to move.

To be more specific, the price of an option is determined by a number of factors, including the price of the underlying asset, the strike price of the option, the time until expiration, and the implied volatility. The higher the implied volatility, the more expensive the option will be, because the market expects the underlying asset to move more.

So why does this matter? Well, if you're a trader, understanding implied volatility can help you make more informed decisions about when to buy or sell options. For example, if you think the market's estimate of implied volatility is too low, you might buy options in anticipation of a big price move. Conversely, if you think the market's estimate is too high, you might sell options to take advantage of the higher premiums.

Of course, there's much more to options trading than just implied volatility, but hopefully this gives you a good basic understanding of what it is and why it's important.

See you all next Friday for our next lesson on options trading!

Chart #3 - Polkadot (DOTUSDT) 1-Day Chart

Chartist: Kyle

(For the chart screenshot, click here.)

DOT has hit its range-low and is bouncing off of that key level.

Similar to Arweave, going forward over the next few weeks, we could see DOT head towards its mid-range level, followed potentially by its range-high.

We don't want to bid blindly though, so it's best to wait for the price to react off of the current zone and then zoom in on a lower timeframe and time our entry right.

Check our Crypto Banter Discord here for updates!

Make sure to follow me on Twitter, where I will post updates on my trades as they unfold!

Claim your Bitget sign-up bonuses here (details below).

Chart #4 - Bitcoin (BTCUSDT) 12-Hour Chart

Chartist: Sheldon

(For the chart screenshot, click here.)

Early this morning, BTC dropped by around $1,500 after growing concerns around the Mt Gox bitcoin putting immense sell pressure on the market.

Initially, the price dropped from $23,500 to $22,000 (support) but has since recovered to $22,350. What concerns me is that BTC has broken its daily ascending support line. But since bitcoin has stabilized, there is a chance it retests $22,600 - $23,000 or possibly even the previous daily support line at $23,400.

If the price continues crashing, the next crucial support level sits between $21,500 - $22,000.

Check our Crypto Banter Discord here for updates!

Follow me on Twitter to get all the updates on my personal trading progress!

Claim your Bitget sign-up bonuses here (details below).

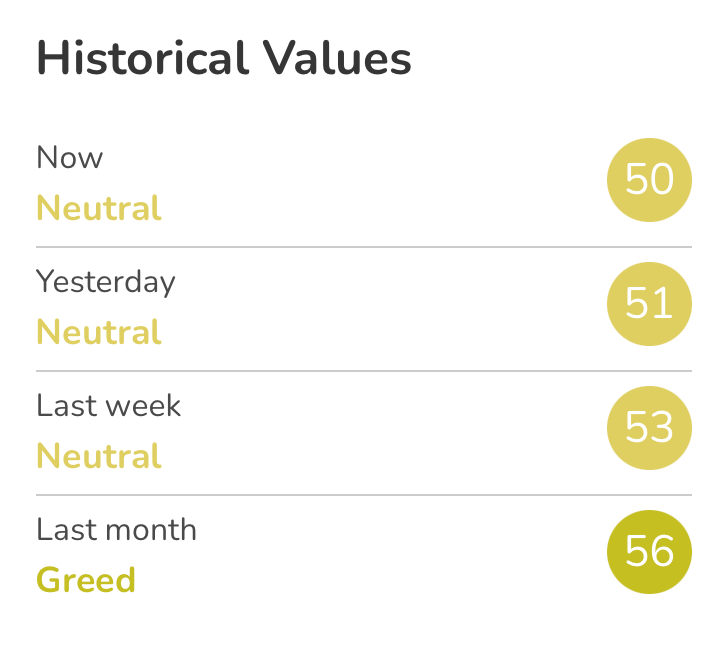

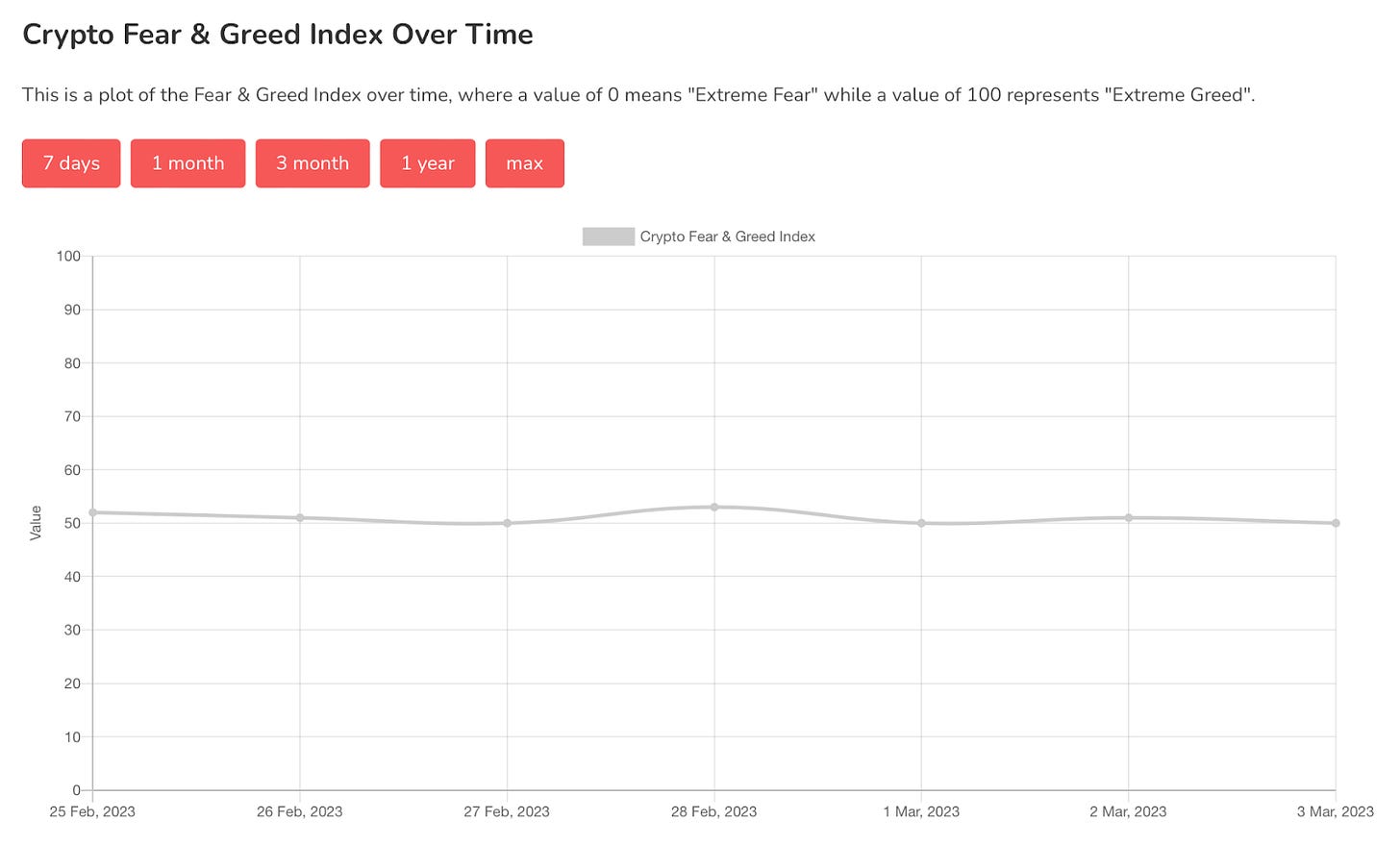

Chart #5 - Bitcoin Fear and Greed Index

The Bitcoin Fear and Greed Index is sitting at 50 today, Neutral.

The highest the index has been over the past seven days is 53, and the lowest is 50.

Overall Market Sentiment (Banter’s Take)

The sell-off has been quick!

So long as the mid-range holds for bitcoin, it should bounce and set a higher low. In the off chance that doesn't occur, bitcoin may start making its way down to $18,000, which would take the rest of the market down with it.

Stay safe my friends!

Bybit winner - 26879801